dupage county sales tax vs cook county

Lexington boston homes for sale. Payments must be received at the local bank prior to close of their business day to avoid a late payment.

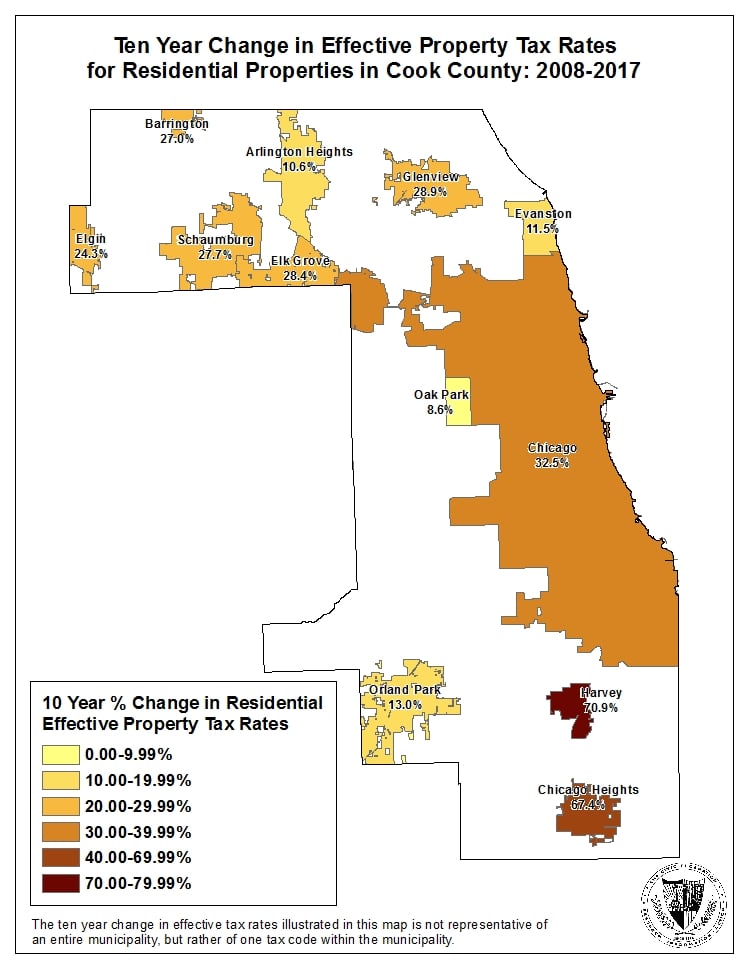

Estimated Effective Property Tax Rates 2008 2017 Selected Municipalities In Northeastern Illinois The Civic Federation

Compare those numbers to nearby cook county where youll pay 8 sales tax or chicago where youll pay 1025.

. The minimum combined 2022 sales tax rate for Dupage County Illinois is. Average Sales Tax With Local. Illinoisans pay a lot in property taxes compared to the rest of the nation -- the state has the second-highest property taxes in the country almost double the national average.

I am in Dupage and my property taxes have ranged between 15 and 25 depending on market conditions and school funding needs for single. The sales tax in Chicago is 875 percent. As of July 1 2021 the aggregate rate for sales tax in the Cook County portion of the Village is 1000.

The Illinois state sales tax rate is currently 625. Published January 27 2021 By. County Farm Road Wheaton Illinois 60187.

How much is sales tax on a car in Illinois. Dupage county illinois cost of. The Dupage County sales tax rate is.

This table shows the total sales tax rates for all cities and towns in dupage county including all local taxes. If youre looking to buy a house the two big numbers youll want to look at are property taxes and quality of schools. According to the Office of the Will County Clerk the 2005 average Will County property tax rate.

People are mentioning taxes. Compare those numbers to nearby Cook County where youll pay 8 sales tax or Chicago where youll pay 1025. Metro-East Park and Recreation District Tax The Metro-East Park and Recreation District tax of 010 is imposed on sales of general merchandise within the districts boundaries.

15 Boulevard Poissonnière 75002 PARIS. Registered tax buyer check-in begins at 800 am. The Tax Sale will start promptly at 900 am and will run until 430-500 pm Using an automated tax sale system we anticipate the sale running for one full day.

Dupage county sales tax on food. That will help your resale value. There also may be a documentary fee of 166 dollars at some dealerships.

This is the total of state and county sales tax rates. Cook VS Dupage Chicago VS Burbs. This is the total of state and county sales tax rates.

DuPage County Administration Building Auditorium 421 N. DuPage was still receiving cannabis use tax dollars which are distributed to all. But what you pay depends on where you live and some residents are spending a lot more than others.

Some cities and local governments in Cook County collect additional local sales taxes which can be as high as 35. Ford County IL Sales Tax Rate. Will County Vs Cook County Property Tax.

In DuPage County property tax rates vary widely between suburbs with 2005. The Cook County sales tax rate is 175. 16491 123rd Avenue Wadena MN 56482 Phone.

Illinois has a 625 sales tax and Cook County collects an additional 175 so the minimum sales tax rate in Cook County is 8 not including any city or special district taxes. Between Cook County and city taxes you pay 1025 combined sales tax in the city of Chicago. By Annie Hunt Feb 8 2016.

At the time the average rate for Cook County including municipal sales tax was about 216 percentage points higher than in DuPage Kane Lake McHenry and Will counties. Has impacted many state nexus laws and sales tax. The base sales tax rate in dupage.

Compare those numbers to nearby Cook County where youll pay 8 sales tax or Chicago where youll pay 1025. 0610 cents per kilowatt-hour. Here are the effective tax rates in Chicago area counties.

Crook county ammo tax - posted in Illinois Politics. Lowest sales tax 625 Highest sales. 1337 rows 2022 List of Illinois Local Sales Tax Rates.

Dupage county vs cook county. Illinois taxes individual income at a rate of 495 and business income at 7. To review the rules in Illinois visit our state-by-state guide.

The Illinois state sales tax rate is currently. These rates were based on a tax hike that dates to 1985. In Cook County outside of Chicago its 775 percent.

So if a county website says the average tax rate for the county is 75 per hundred dollars of value a builders sales rep will probably say that the rate is 25 25 per hundred dollars of sale price 13 of 75. The Regional Transportation Authority RTA is authorized to impose a sales tax in Cook DuPage Kane Lake McHenry and Will counties. Has impacted many state nexus laws and sales tax collection requirements.

In DuPage County its 675 percent and. Cook has higher sales taxes but both Cook and DuPage have higher property taxes depending on which town youre in. Recently I looked online at a 2 flat in a Cook County suburb and nearly fell out of my chair when the real estate agent told me what the property taxes were.

Cutting horse shows in oklahoma. The 2018 United States Supreme Court decision in South Dakota v. Dupage county sales tax vs cook county.

Douglas County IL Sales Tax Rate. The 2018 United States Supreme Court decision in South Dakota v. Has impacted many state nexus laws and sales tax collection requirements.

Illinois relies more than Indiana on individual and business income taxes. Keep in mind that low property tax rates dont mean a county is the best place to invest in nor do high property tax rates mean a county should be out of the running. What about your take-home pay.

The county missed out on up to 4 million in estimated revenue over the 18 months the tax went uncollected. What is the sales tax rate in Dupage County. 117 rows A county-wide sales tax rate of 175 is applicable to localities in Cook County in addition to the 625 Illinois sales tax.

The 2018 United States Supreme Court decision in South Dakota v. Heres how Cook Countys maximum sales tax rate of 115 compares to other counties around the United. Molding today into tomorrow.

Thanks to the DuPage County sales tax reduction the new rate for services and parts is 75 and the new rate for cars is 7. To include all counties in Illinois purchased dupage county sales tax vs cook county car from a Cook County Dealer will collect more 925.

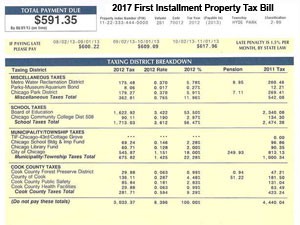

Cook County Triennial Property Tax Assessment Schedule Kensington

2017 Effective Property Tax Rates In The Collar Counties The Civic Federation

Ten Year Trend Shows Increase In Effective Property Tax Rates For Collar County Communities The Civic Federation

Cook County Property Taxes 2017 2nd Installmant Looms Kensington

How To Determine Your Lake County Township Kensington Research

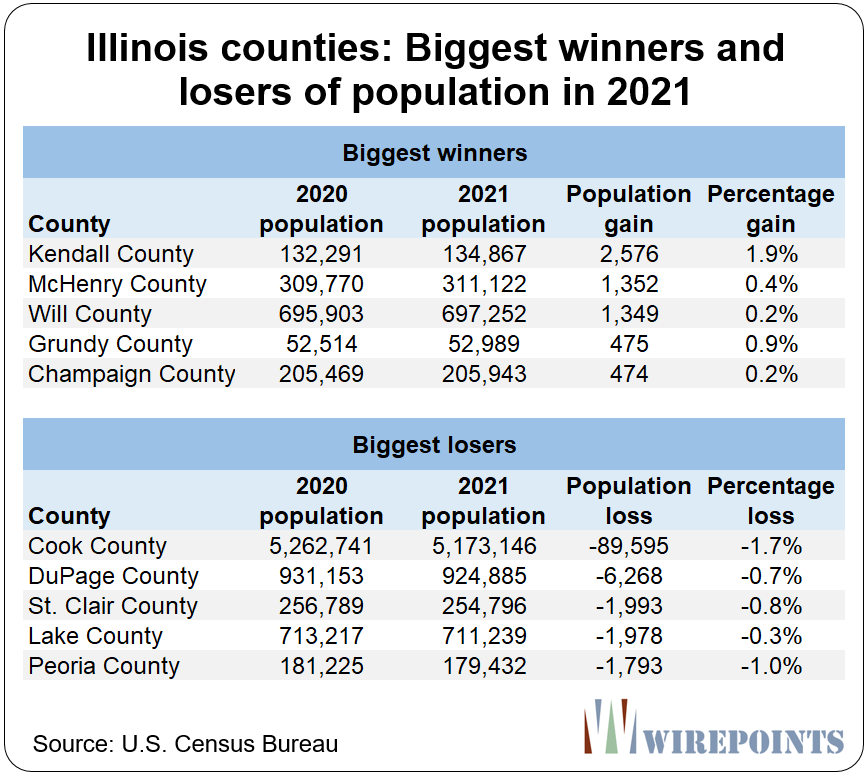

New Census Release 81 Of Illinois 102 Counties Lost Population In 2021 Cook County Lost The 3rd Most Nationwide Wirepoints Wirepoints

Illinois Supreme Court Strikes Down County S Tax On Firearms

Cities In Cook County Complete List Of Cook County Cities Towns Villages With Population Data Map Information More

Dupage County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

Residential Effective Property Tax Rates Increased Across Cook County In Last Decade The Civic Federation

Ten Year Trend Shows Increase In Effective Property Tax Rates For Cook County Communities The Civic Federation

Chicago Il Property Tax Rate Store 50 Off Edetaria Com

Residential Effective Property Tax Rates Increased Across Cook County In Last Decade The Civic Federation

State Legislature Approves Remap Of Judicial Subcircuits

Cook County Addresses Unincorporated Pockets Chicago Agent Magazine

Cook County Property Taxes Due August 1 2018 Fausett Law Offices

What Cook County Township Am I In Kensington Research

Kane Joins Dupage As West Suburban Region In State S New Covid 19 Mitigation Plan Kane County Connects